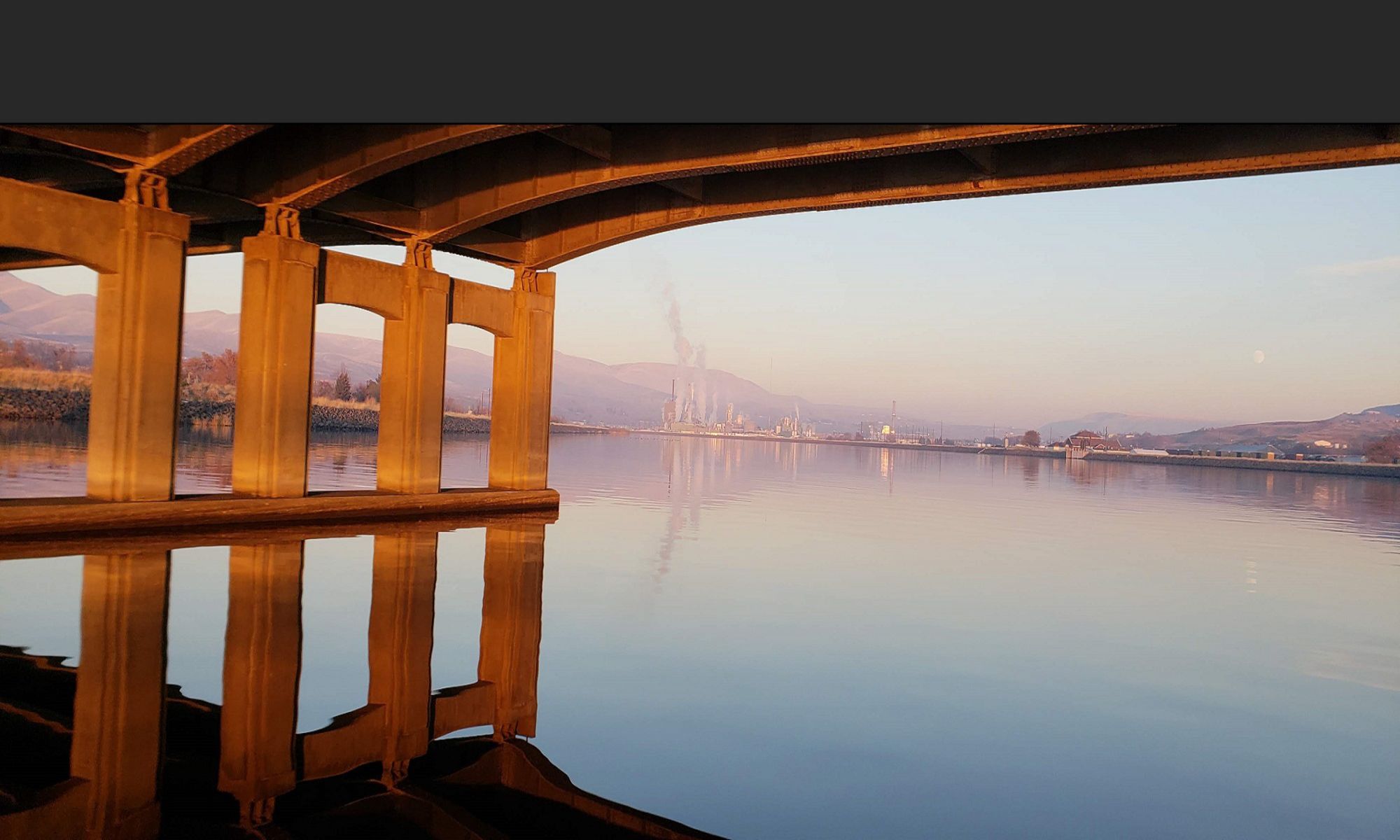

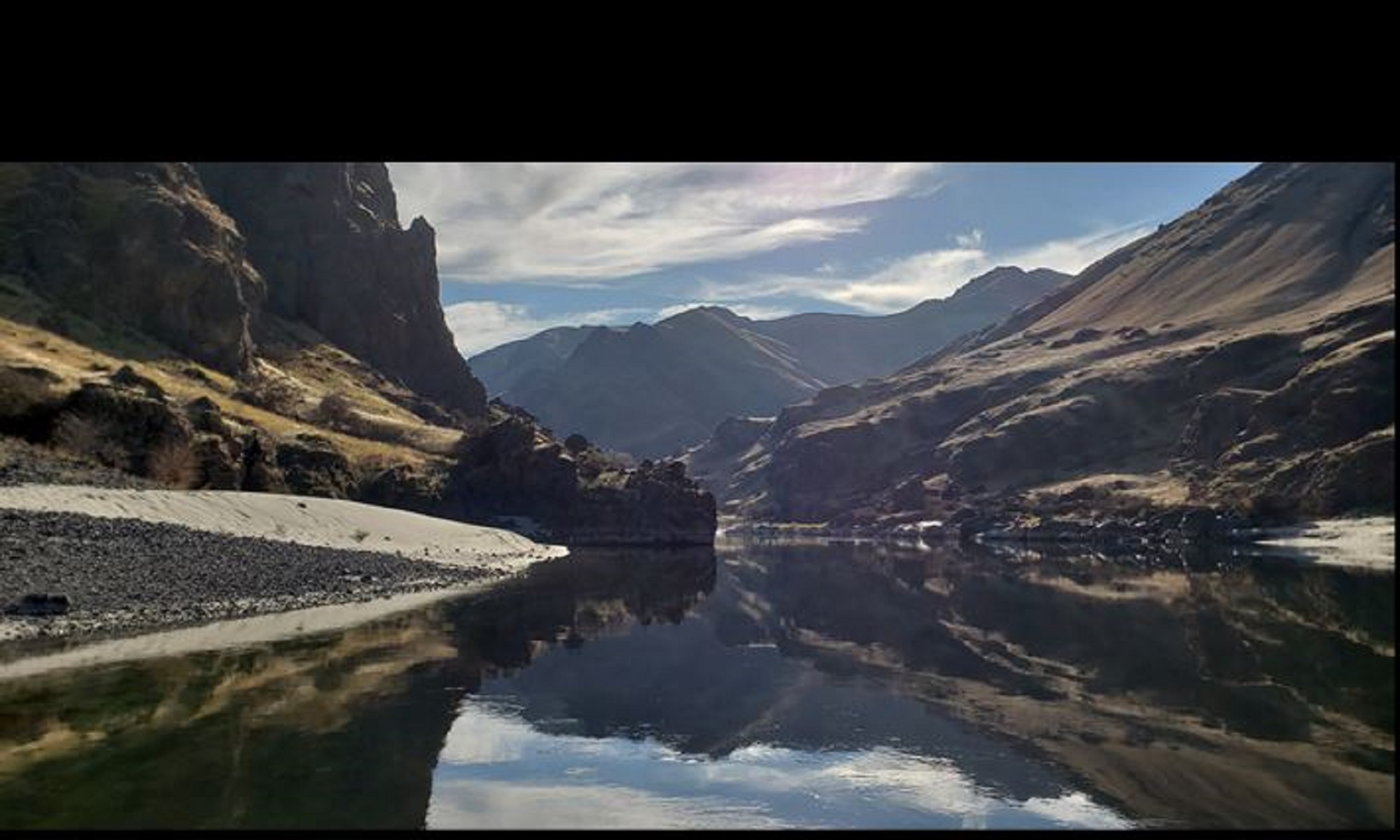

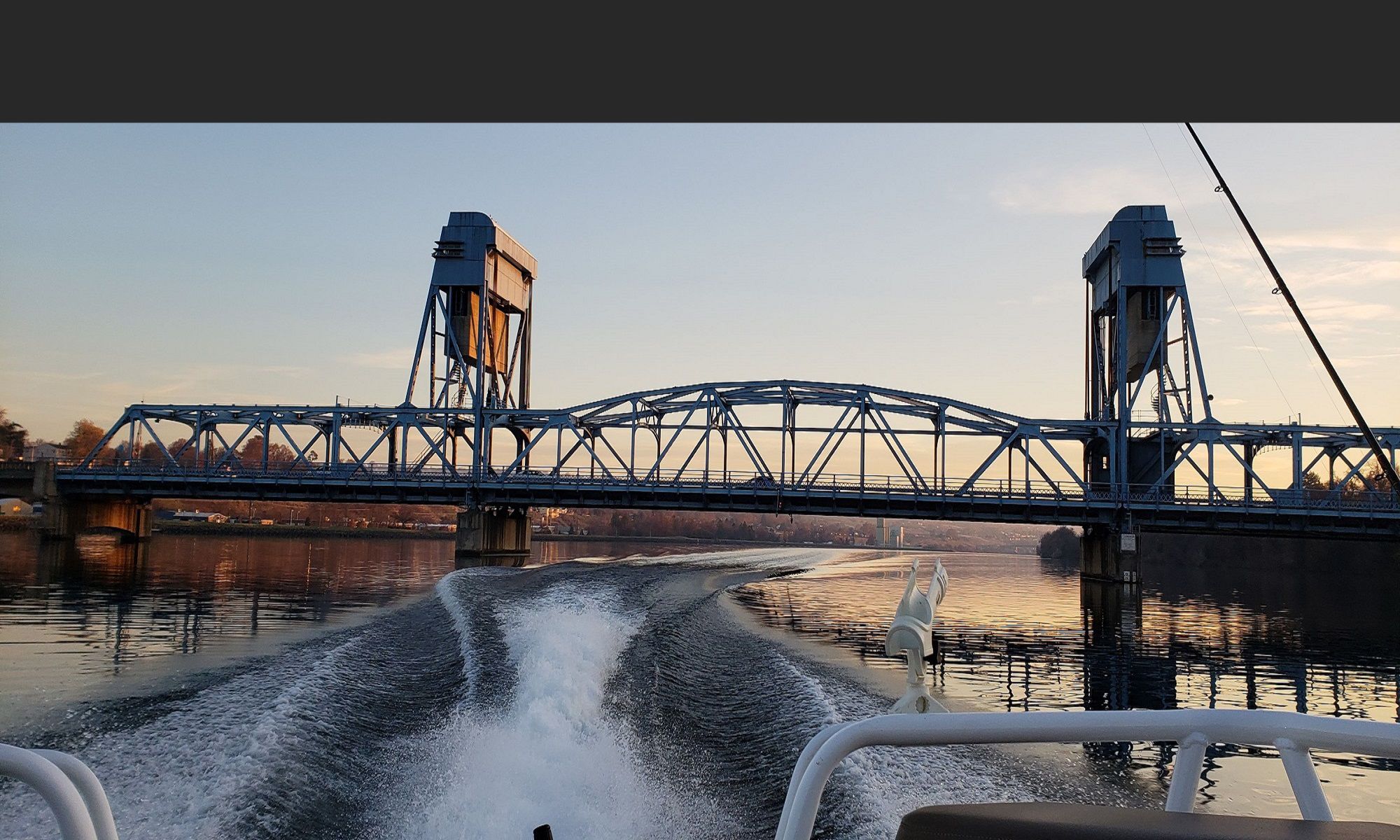

Investing in the Lewis Clark Valley Since 1979

The Valley’s Only Locally Owned Bank – Managed by Local Folks

- 4 Valley Locations – Convenient, Easy Parking, Drive-up Windows, Night Deposit Drops, ATMs

- Online Banking – eStatements & Check Images

- Mobile Apps – Bill Payment & Remote Check Deposit

- Home Loans, Construction Loans, Rental & Investment Properties – Online Mortgage Application

- Business Online Banking – Cash Management, Direct Deposit Payroll, Remote Deposit Capture, Additional Employee User Security Settings

- VISA ATM / Check Card – MoneyPass ATM Network (no fee charged on thousands of ATMs nationwide)